Infrastructure Funds: The infrastructure gap in Nigeria remains extremely high. The World Bank estimates that Nigeria needs to invest atleast $3 trillion by 2050 to address the current infrastructure gap and to maximize its economic potential. For global pension fund managers and institutional investors, investing in the infrastructure sector in Nigeria presents a great opportunity for portfolio diversification as well as stable long term, uncorrelated and predictable returns, especially, in the light of the recent legal changes to the framework for investing in infrastructure as well as structural changes in the FX market.

For global pension funds and institutional investors investing in Nigeria’s infrastructure sector for the first time, investing in Nigeria through an infrastructure fund addresses some of the traditional risks associated with emerging/frontier markets and provides some level of risk management. This legal update outlines some key protections for infrastructure fund investors in Nigeria.

What is an Infrastructure Fund?

The SEC Rules on Infrastructure Funds (the “SEC Rules“) defines an infrastructure fund as a specialised fund that invests in the securities or securitized debt instruments of any of (a) an infrastructure company; (b) an infrastructure capital company; (c) an infrastructure project; (d) special purpose vehicles which are created for the purpose of facilitating or promoting investment in infrastructure, and (e) other permissible assets including revenue generating projects of infrastructure companies or projects or special purpose vehicles.

The SEC Rules do not define the term “infrastructure”. However, from an investor’s standpoint, an infrastructure investment is traditionally an investment in essential services, which is not exposed to volatile commodity pricing and which offers downside protection, in that, the investment perform well irrespective of economic cycle. Typically, such investments would have a high barrier to entry by way of a monopoly or long-term contracts, will be capex-intensive and will have sufficient capital flow to pay back investors.

Based on the statutory definition contained in the extant Infrastructure Concession Regulatory Commission Act, “infrastructure” has been defined under Nigerian law to include: “power plants, highways, seaports, airports, canals, dams, hydroelectric power projects, water supply, irrigation, telecommunications, railways, interstate transport systems, land reclamation projects, environmental remediation and clean-up projects, industrial estates or township development, housing, government buildings, tourism development projects trade fair complexes, warehouse, solid wastes management, satellite and ground receiving stations, information technology networks and database infrastructure, education and health facilities, sewerage, drainage, dredging, and other infrastructure and development projects“

Given the rapid changes in technology, today, infrastructure can also include, electric vehicle charging networks, hydrogen distribution, battery storage, 5G telecom networks, data centers, smart motorways and rail technology.

Market Snapshot

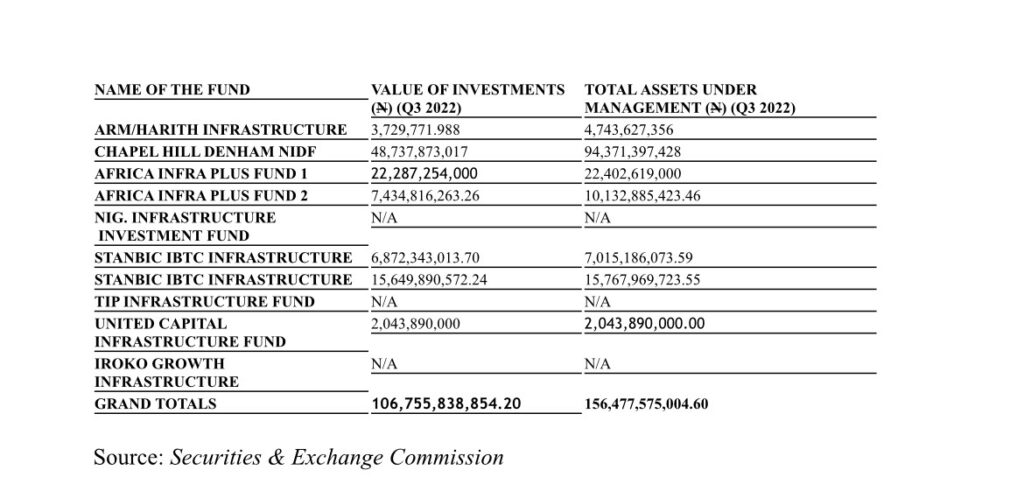

Based on Q3 2022 data available from the SEC, there are a total of 10 infrastructure funds registered with the SEC, with a total AUM of N156,477,575,004.60. The funds are primarily Naira-denominated funds. On October 5, 2023, one of the registered infrastructure funds, the Nigerian Infrastructure Development Fund (the “NIDF“), was listed on the Nigerian Stock Exchange (the “NGX“). The NIDF listed 853,817,592 units at N108.39 per unit, adding a total of N92.54 Billion to the market capitalisation of NGX.

How are Infrastructure Funds Regulated?

Infrastructure funds structured as collective investment schemes must be registered with the Securities and Exchange Commission (the “SEC“). Infrastructure funds are also subject to a number of qualitative requirements, some of which are listed as follows:

(a) A minimum of 90% of the net assets of an infrastructure fund must be invested directly or indirectly in infrastructure projects which are revenue-generating.

(b) A minimum of 90% of the net assets of an Infrastructure Fund must be invested in Nigeria.

(c) An infrastructure fund can invest in money market instruments, structured loans and bank deposits for liquidity purposes to cover costs and/or other expenses associated with the fund.

(d) With exception to infrastructure funds established for a specific infrastructure project or company, an infrastructure fund may invest up to 70% of its net assets in one infrastructure company or project. However, an infrastructure fund cannot invest above 30% of its net assets in an infrastructure project or company that is unrated or rated below investment grade.

(e) Units of an infrastructure fund may be listed on a recognized exchange, provided that such units shall be listed only after being fully paid up.

(f) An infrastructure fund may be an open or close-ended scheme but must have a minimum tenor of 7 years or an interval scheme with a lock-in of 5 years and an interval period not longer than one month as may be specified in the scheme information document.

How are Infrastructure Fund Managers Regulated?

Infrastructure fund managers must be registered with the SEC and must have a minimum of 2 key personnel with relevant experience in the infrastructure sector. Additionally, the sponsor or the parent company of the sponsor of an infrastructure fund must have been carrying on activities or business in infrastructure financing sector for a period of not less than 5 years. Infrastructure fund managers are also subject to a number of qualitative requirements which are listed as follows:

(a) The management fees of a infrastructure fund manager is capped at 2% per annum of the assets under management

(b) Performance fee/carried interest/incentive fee may only be charged once a fund has delivered the hurdle or base rate of return disclosed. This shall not exceed 20% of the profit generated by an infrastructure fund in excess of the hurdle rate.

(c) An infrastructure fund manager is generally prohibited from investing in any unlisted or listed security of the fund’s sponsor, manager or related company. However, an infrastructure fund can invest up to 25% of the net assets of the fund, subject to approval of the Trustees and full disclosures to investors.

(d) Transactions by employees of a fund manager or trustee in a portfolio company are to be notified to the fund manager or to the trustee as the case maybe, prior to consummation and also to be notified to the relevant compliance officer, within a month from the date of such transaction.

(e) Infrastructure fund managers are subject to standard reporting and disclosure obligations, which includes the obligation to (i) submit quarterly returns of the fund’s activities to the Trustees and the SEC in the required format (ii) audit the fund annually and file reports of such audits with the SEC within three (3) months of the fund’s year end (iii) send annual report of the fund or an abridged summary to investors in electronic form on their registered e-mail addresses immediately upon approval by the SEC (iv) display the link to the fund’s full annual report prominently on its website.

(f) A fund manager must engage a SEC-registered consultant to value the assets of the fund on a “good faith” basis, semi-annually and based on valuation methods approved by the trustees to the fund. Such valuation principles must be disclosed to investors and be reviewed periodically by the trustee and statutory auditors. Additionally, the said SEC-registered must be replaced every 3 years.

(g) A fund manager must disclose the indicative portfolio of an infrastructure fund to its potential investors stating the type of assets the fund would invest in.

(h) A fund manager must act honestly and fairly, with skill, care and diligence, and in the interest of investors and the securities industry.

Final Analysis

Given the gaping infrastructure gap, there are still not enough infrastructure funds in the country and the amounts raised for infrastructure projects so far, although commendable, still appears insignificant. It is hoped that more infrastructure funds will be formed and registered with the SEC, in the coming years.

Balogun Harold provides this information as a service to clients and other friends for educational purposes only. The foregoing information should not be construed or relied on as legal advice or to create a lawyer-client relationship. Readers should not act upon this information without seeking advice from professional advisers. Kindly seek professional advice specific to your situation. You may also reach out to your usual Balogun Harold contact or via support@balogunharold.com for support.