Compared to other African countries, Nigeria has one of the most investment-friendly laws and continues to be an attractive destination for foreign direct investments in Africa. More than previously, attracting FDI inflows is top priority for the administration of Nigeria’s new President, Bola Ahmed Tinubu, as the administration continues to shape the foreign direct investment legal landscape to make Nigeria, more attractive, as an investor-friendly jurisdiction. From a macro-standpoint, Nigeria remains Africa’s largest economy with a total real GDP of $518bn (N239trn) at the end of 2022. Nigeria still remains the preferred gateway into the African market and the vast potential of its markets, human capital, and natural resources remains under-utilized. Geographically, the country is also strategically situated as the economic hub for West Africa. Nigeria’s legal system is based on English common law and foreign investors often choose english law as the governing law of their investment agreements.

(1) Recent Updates

The Decentralisation of the Power Sector in Nigeria

In a bid to stimulate foreign direct investments in Nigeria, Nigeria has recently effected a change in its Constitution to allow individual States within Nigeria to regulate the generation, distribution and transmission of electricity in their respective internal electricity markets. Prior to this time, only the Federal Government could regulate the generation, distribution and transmission of electricity across Nigeria.

The Decentralisation of the Railway Transport Sector in Nigeria

In a bid to stimulate foreign direct investments in Nigeria, Nigeria has recently effected a change in its Constitution to allow individual States within Nigeria to regulate the establishment and maintenance of railway tracks and infrastructure within their respective internal railway transport markets. Prior to this time, only the Federal Government could regulate the generation, distribution and transmission of electricity across Nigeria. With the constitutional amendment, the powers of the Federal Government will now be limited to the construction and maintenance of inter-state railway tracks and infrastructure, including the establishment of a national railway agency for the regulation of railway operations and the establishment and maintenance of a national railway carrier for inter-state transportation throughout the Federation.

Removal of Petroleum Subsidies in Nigeria

In a bid to stimulate foreign direct investments in Nigeria, the new administration in Nigeria has also eradicated the petroleum product subsidies which were first introduced in 1977 by the military government as a short-term cushion for the rising international oil price. Although subsidies were introduced as a temporary fiscal response to an oil price spike instigated by the actions of Organization of the Petroleum Exporting Countries (OPEC), subsequent governments in Nigeria have retained the petroleum subsidy as a mechanism for stabilising domestic fuel prices and as a social welfare strategy. Nigeria allegedly spent $10 billion on petroleum subsidy in 2022 and the new administration has taken the view that petroleum subsidies are no longer sustainable in Nigeria.

Unification of Official and Parallel Market Exchange Rates

In a bid to provide promote greater transparency in the exchange market and to promote foreign direct investments in Nigeria, the Nigerian government has officially unified the official and parallel market rates into a single rate, with the effect that the applicable foreign exchange rate will subsequently be determined by market forces rather than government intervention.

Public Private Partnerships in Nigeria

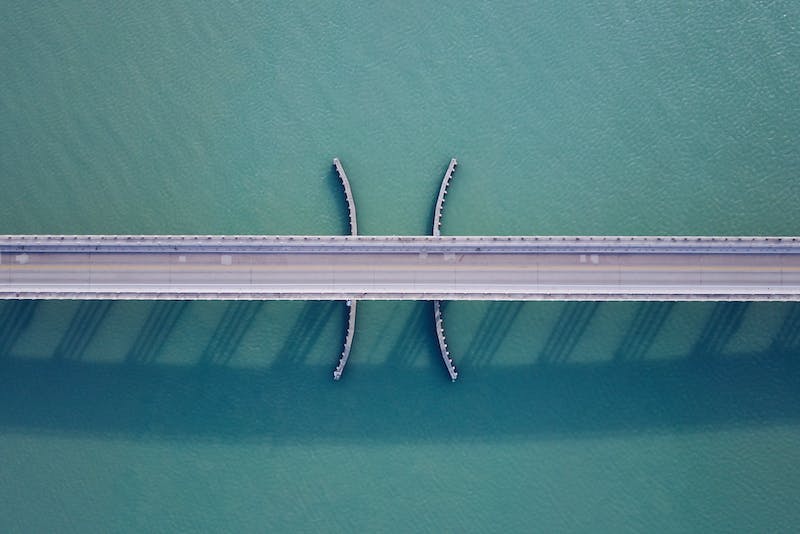

Public private partnerships have long been a strategic tool for attracting foreign direct investments to Nigeria. The country commenced a process for the commercialisation and privatisation of its public assets in 1999. As far back as 2005, Nigeria established the Infrastructure Concession Regulatory Commission (the “ICRC“) to regulate public private partnerships in the infrastructure sector in Nigeria. The categories of infrastructure subject to the regulatory purview of the ICRC includes power generation and transmission/distribution networks, as well as roads and bridges; ports, railways; logistics hubs; gas and petroleum infrastructure; water supply; water treatment and distribution; solid waste management; educational facilities; transport systems; housing and health care facilities.In 2022, over 50 public private partnership projects, across the education, aviation, energy, health, real estate, ports, ICT sectors, valued at NGN 6,920,790,404,621 (Six Trillion, Nine Hundred and Twenty Billion, Seven Hundred and Ninety Million, Four Hundred and Four Million, Six Hundred and Twenty-One Million Naira were slated as eligible for 2022.

States governments have enacted laws to regulate foreign investment in their respective states by way of public private partnerships.

2. Key Elements of Foreign Direct Investments in Nigeria

(a)Registration of Companies in Nigeria

A company can now be established in Nigeria online and within 48 hours. A Nigerian company can be registered with a minimum of 1 foreign shareholder who may own a 100% of the equity of a Nigerian company.

(b)Foreign Direct Investment in sectors of the Nigerian Economy

A foreign investor can generally invest in all the sectors of the Nigerian economy except for businesses listed on the Negative List. Businesses on the Negative list include (a) production of arms & ammunition, etc.; (b) production of and dealing in narcotic drugs and psychotropic substances; (c) production of military and para-military wears and accoutrement, including those of the Police and the Customs, Immigration and Prison Services. Foreign investors are also generally prohibited from investing in the private security sector.

There are also local content requirements. Certain critical sectors like the oil and gas sector require a minimum of 51% Nigerian ownership. In the Aviation sector, only a Nigerian citizen can apply for an aviation license. In the Engineering sector, companies must have Nigerian directors registered with the COREN holding at least 55% of the company’s shares. In the advertising sector, only a national agency (that is, an agency in which Nigerians own not less than 74.9% of the equity) can advertise to the Nigerian market. The use of foreign-owned or manned vessels for coastal trade is generally prohibited in Nigeria.

(c)Special Investment Routes in Nigeria IRO foreign direct investments in Nigeria

There are no special routes for foreign direct investment in Nigeria. Accordingly, foreign investors may automatically participate in local business without prior government approval by way of a direct investment or a portfolio investment in a Nigerian company. Mergers and acquisition transactions are generally subject to competition review

Investors may only invest in economic zones and an carry on specific activities in such economic zones. These include, manufacturing of goods and services; warehousing freight forwarding and customs clearance; Handling of duty free goods(transhipment, sorting, marketing, packaging, etc); Banking, stock exchange and other financial services; insurance and re-insurance; Import of goods for special services, exhibition and publicity; International commercial arbitration services; and activities relating to integrated zones.

(d) Repatriation of Profits/Funds from Nigeria

Investments in Nigeria can be made by way of cash or by way of plant, equipment or machinery. Funds can be repatriated from Nigeria using a variety of methods. These include, by way of:

i. Royalty Payments

ii. Dividend Payments

iii. Reduction of Share Capital

iv. Buyback of Shares

v. Technical/Consultancy Fees

vi. Upon winding up of local entity

(e) Investor Guarantees & Incentives IRO foreign direct investments in Nigeria

Nigeria’s investment laws provide express guarantees against nationalisation or expropriation and prohibits government agencies from compelling any foreign investors to surrender his/her investments to another person. In the event of an acquisition which, must be in the national interest or for a public purpose, Nigeria’s investment laws mandates that a law must to provide for such “national interest” acquisitions and that there must be a payment of a fair and adequate compensation. Foreign investors are also entitled to a variety of tax-based incentives, tariff-based incentives and sector-focused incentives.

How foreign investors can manage the risks of foreign direct investments in Nigeria

The nature of the risks associated with an investment and the approach to managing such risks is highly dependent on the sector of investment and often requires some analysis. For instance, our experience suggests that investors whose businesses will require importation of goods through the Nigerian Customs Service will require an additional level of diligence and administrative efficiency, to manage sector-specific risks. Overall, it is prudent for investors to engage legal counsel who are familiar with the particular federal, state and sectoral landscape that they wish to invest in so as to be acquainted early-on with the particular restrictions or rules which apply to their sectors of interest.

The foregoing insight is not intended to constitute legal advice and is not prepared with a specific context in mind. Kindly seek professional advice specific to your situation. You may also reach out to your usual Balogun Harold contact or via support@balogunharold.com for support.